An overview of global performance, growth drivers, and investment momentum

Executive Summary

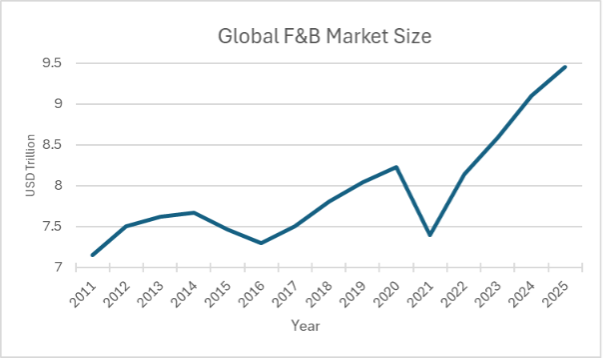

The global food and beverage industry is valued at approximately USD 9.44 trillion in 2025, based on the aggregate retail (RSP), off-trade, on-trade, and foodservice sales across major product categories, including food, beverages, and consumer foodservice, expressed at current prices.

Industry expansion is driven by health-conscious consumption and convenience-led purchasing, supported by rising incomes and urbanization in emerging markets.

Investor activity remains strong, characterized by steady deal growth and stable long-term returns. With a projected CAGR of around 4% for 2025-2030, the sector offers a low-risk investment profile, supported by resilient consumer demand and ongoing innovation.

Market Definition and Scope

The market under consideration is the Global food and beverage sector, including consumer foodservice, staple foods, snacks, cooking ingredients and meals, dairy products and alternatives, hot drinks, alcoholic drinks, and soft drinks.

Market value is reported at Retail Selling Price (RSP), representing B2C consumer expenditure across four distinct sales channels. Retail Value RSP is used for packaged foods and hot drinks sold through retail outlets; Off-trade Value RSP captures beverages (both alcoholic and soft drinks) sold through stores; On-trade Value RSP for those beverages consumed in hospitality venues; and Foodservice Value RSP covers total spending across restaurants, cafés, and catering establishments.

In addition to this scope, the global fresh food market includes unprocessed meat, seafood, eggs, fruits, vegetables, nuts, pulses, and roots. This market represents several trillion dollars in value, though measured primarily in volume terms.

Global Market Overview

According to Euromonitor International (2025), the global market size is USD 9.44 trillion in 2025. Based on current projections, the global food and beverage industry is expected to expand to USD 11.42 trillion by 2030, representing a compound annual growth rate (CAGR) of 3.91% over the forecast period, according to Mordor Intelligence (2025).

The category leaders for 2025 highlight the subsectors contributing most to overall industry value, where consumer spending and growth are most concentrated. Consumer Foodservice leads with 33.5% of the market, including cafés/bars, full-service restaurants, limited-service restaurants, self-service cafeterias, and street stalls/kiosks. Staple foods follow with 12.4%, encompassing baked goods, breakfast cereals, processed fruit and vegetables, processed meat, seafood, and meat alternatives, rice, pasta, and noodles. Alcoholic drinks rank third with 9.6%, consisting of beer, cider/perry, ready-to-drink (RTDs) beverages, spirits, and wine.

Mordor Intelligence (2025) reports that “global growth in the food and beverage industry is supported by health-conscious consumption, convenience-led purchasing, and the digital transformation of retail and foodservice,” highlighting how evolving consumer behavior continues to shape investment and innovation opportunities across the sector.

Regional Insights

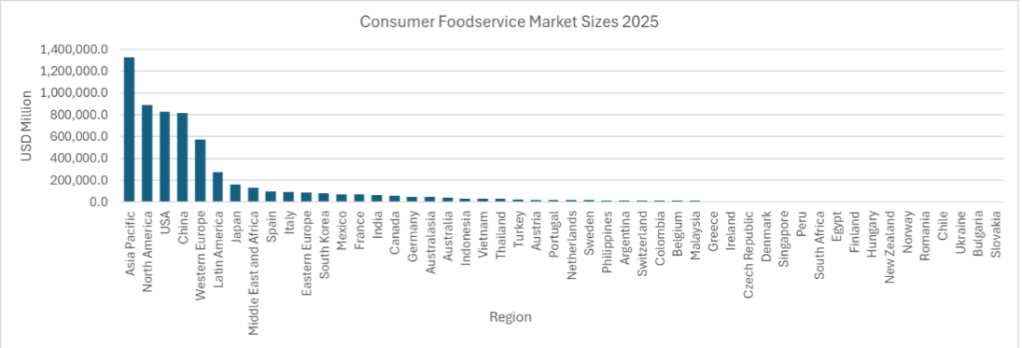

Within the global food and beverage industry, the consumer foodservice sector shows regional contrasts.

The Asia-Pacific (APAC) region continues to experience rapid structural growth, accounting for roughly 40% of the global consumer foodservice market with about USD 1.3 trillion in foodservice Value RSP. McKinsey (2025) highlighted that APAC’s consumption patterns are driven by urbanization, rising disposable incomes, and growing health awareness.

North America, a more mature market, makes up approximately 27% of the global consumer foodservice market, with around USD 889 billion in foodservice Value RSP. According to PwC (2025), growth for this region is supported by closer integration with adjacent industries such as healthcare, financial services, and technology. This reflects consumers’ growing demand for health-focused, digital, and convenience-driven experiences.

Investment Landscape

Looking at current capital trends, global PE and VC deal value rose by 25% from the previous year, reaching USD 639 billion in 2024, according to S&P Global (2025). M&A activity has also strengthened, with a reported deal volume of USD 149.9 billion in 2024 compared with 2023’s USD 83.1 billion. These trends reflect continued investor confidence and a robust investment landscape across the food and beverage sector.

From an investment perspective, the F&B industry, with a CAGR of 3.91% for 2025-2030, is seen as a stable, low-risk sector with steady returns. Its growth exceeds most developed consumer-goods categories, such as household and personal care, but remains less volatile and speculative than high-risk, high-growth sectors like blockchain startups.

Outlook and Opportunities

The key investment themes are health-focused innovation and digitalization.

Health-focused innovation, represented in the functional foods and beverages segment (products offering added health or nutritional benefits), is expected to grow at a CAGR of 7-8% (2025-2030), doubling that of the overall food and beverage market. This reflects an increased consumer preference for wellness-oriented products and innovation in nutrition.

Digitalization is reshaping the F&B industry through online delivery, e-commerce, and data-driven operations. The online food delivery market is expanding at an estimated 10-12% CAGR (2025-2030), and food tech investment exceeded USD 2 billion in 2024, highlighting the sector’s shift toward consumer convenience and digital efficiency.

Sources: Insights and data were drawn from leadingEuromonitor International, McKinsey & Company, PwC, Mordor Intelligence, CB Insights, S&P Global, The Food Institute, Statista, Deloitte, PitchBook, Innova Market Insights, and EY.

Written by Anisa Anaya, 2025.

Leave a comment